Compute the Gross Profit for Fifo Method and Lifo Method

Click Calculate Fifo or Calculate Lifo according to your need. Sales Revenue 418 Cost of Goods Sold 280 Gross Profit 138 Requirement 3.

1a Ch 6 Gross Profit Fifo Youtube

7200 see last row of balance column ii.

. Type the total units solved in the textbox. Entification should be used when building custom race cars. Number of units in ending inventory.

LIFO Last-In First-Out is one method of inventory used to determine the cost of inventory for the cost of goods sold calculation. 5 x - 12 2x - 7 original equation 5 -05 - 12 2 -05 - 7 plug in value of x 5 -05 - 12 -1 - 7 did multiplication -75 -8 did addition on both sides since -75 is obviously not equal to -8 the value of -05 for x is wrong. Inventory accounting assigns values and revenue figures.

Ideally there are two inventory valuation methods or accounting methods. 1 Calculate gross profit Net Sales x Gross Profit Percentage. LIFO valuation considers the last items in inventory are sold first as opposed to LIFO which considers the first inventory items being sold first.

Ending inventory Beginning inventory Purchases made during the month Units sold during the month 500 units 1500 units 1400 units 600 units 800 units 700 units 1500 1 First in first out FIFO method. We need to prepare a perpetual inventory card using LIFO method to find ending inventory cost of goods sold and gross profit. Which method results in a higher cost of goods sold.

All the methods FIFO LIFO WA SPID Retail Method and Gross Profit Method all find the ending merchandise inventory for the periodic system FIFO. Click to see full answer. Trying x -05.

Shaw Chapter 5 Problem 4PSB. FIFO has the lowest cost of goods sold because the oldest units are sold first and this generates the higher level of profit 1500. C-Ost of goods sold.

Companies use the LIFO inventory method to reduce income taxes. Gross profit under perpetual-lifo. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO.

C-Ompute the gross margin for UFO method. Information for 5th Edition Ken W. Higher net income means higher profit margin.

Textbook solution for Financial Managerial Accounting. How do you calculate gross profit FIFO. Click to see full answer.

The amounts debited to the inventory account depend on the inventory costing method used. The fifo and lifo calculator calculate ending inventory cost according to first in first out and last in first out method. 2000 6000 3900 11900 total of sales column iii.

Cost of ending inventory under perpetual-lifo. We have step-by-step solutions for your textbooks written by Bartleby experts. When using the LIFO inventory costing method the most recent costs are assigned to the cost of goods sold.

Since LIFO sells the newest units first the cost of goods sold is higher and the profit is lower 900. 2 Calculate COGS Net Sales - Estimated Gross Profit. Finally the weighted average method generates a profit level between FIFO and LIFO 1200.

Gross profit method Add together the cost of beginning inventory and the cost of purchases during the period to arrive at the cost of goods available for sale. Add more fields if needed. 3480 GENERAL ADMIN EXPENSE Office Salaries Expense DEBIT.

Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Multiply 1 - expected gross profit by sales during the period to arrive at the estimated cost of goods sold. Date Particulars Units Rate Tk.

580 Sales Staff salaries Debit. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. Compute the gross margin for FIFO method and LIFO method.

Goods 11urchased Cost of Goods Sold Cost per Cost per. Trying x 0. It doesnt matter at all whether you want to calculate lifo and fifo for ending inventory the calculator will shows.

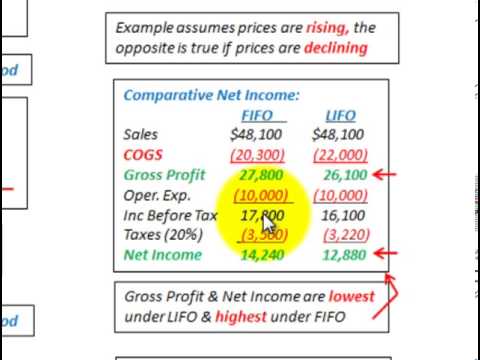

Gross profit 1675 1668 Expenses 1250 1250. Review the cost of goods sold and. When inventory costs are rising LIFO results in the highest cost of goods sold and the lowest gross profit.

580 Rent Expense- Office space Debit. Cost of goods sold COGS Ending inventory value. Cost of goods sold under perpetual-lifo.

Follow these steps to use the FIFO LIFO calculator. 1400 Office supplies Expense Debit. Gross Profit Rate Gross Profit We know Gross Profit Rate 100 Sales LIFO FIFO Average 3050 3230 3174 Gross Profit Rate 100 100 100 10300 10300 10300 2961 3136 3081 Alternative Method Calculation of cost of goods available for sale Periodic Method.

These are two mostly used inventory methods for record keeping that are feasible on accounting standards. Cost of Goods Sold. Hemming uses a perpetual inventory system.

Cost of goods sold Gross profit 18100 18900 Required 2 Required 3 6 O t 1 of 2 Required information Use the following information for the Exercises 8-10 below. Round Gross profit ratio answer to 1. A company using FIFO to value its inventory reports lower COGS which increases its gross profit margin sales less COGS and its net income all else being equal.

To calculate FIFO First-In First Out determine the cost of your oldest inventory and multiply that cost by the amount of inventory sold whereas to calculate LIFO Last-in First-Out determine the cost of your most recent inventory and multiply it by the amount of inventory sold. Businesses are often confused about FIFO Vs LIFO. Total cost of goods purchased.

When inventory costs are rising LIFO results in the highest cost of goods sold and the lowest gross profit. FIFO LIFO Sales revenue Less. The FIFO First-In First-Out method means that the cost of a companys oldest.

A company using LIFO reports higher COGS translating into lower gross profit net income and profit margins. LIFO Last-in first-out and FIFO First-in first-out. Compute the gross profit sales minus cost of goods sold and the gross profit ratio for 2022 assuming that Cast Iron purchased 32000 units as per the first assumption and 17000 units as per the second assumption during the year and uses the FIFO inventory cost method rather than the LIFO method.

3 Calculate Ending Merchandise Inventory MAFS - COGS. Calculation of Gross Profit using Calculated Inventories of FIFO and AVCO Calculation of Gross Profit Perpetual. Last in first out LIFO method.

Hint Print Required 1 Required 2 Required 3 References Compute the gross profit for FIFO method and LIFO method. 2900 TOTAL selling expense Credit. To calculate gross profit perpetual and gross profit periodic we take calculated inventories of FIFO from First in First out Method page and AVCO inventories from Weighted Average Cost Method page.

Sales revenue Less. 17100 EXPENSES SELLING EXPENSE Advertising Expense Debit. Cost of Goods Purchased.

If you want to use LIFO you must elect this. 2400 Insurance Expense Debit.

Fifo Vs Lifo Comparison Double Entry Bookkeeping

Lifo And Fifo Inventory Accounting Comparing Net Income Ending Cash Balance Youtube

Details Of The Fifo Lifo Inventory Valuation Methods Method Financial Management Sample Resume

No comments for "Compute the Gross Profit for Fifo Method and Lifo Method"

Post a Comment